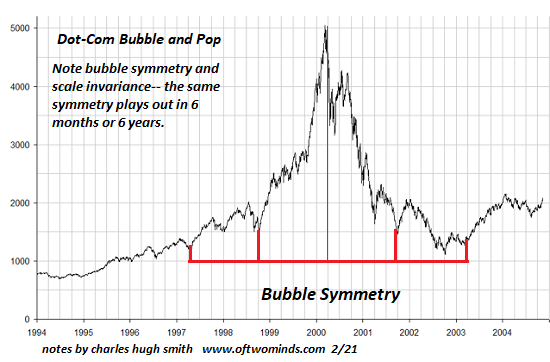

Many financial bubbles end up from where they started. From Charles Hugh Smith at oftwominds.com:

Should bubble symmetry play out in the S&P 500, we can anticipate a steep 45% drop to pre-bubble levels, followed by another leg down as the speculative frenzy is slowly extinguished.

Bubble symmetry is, well, interesting. The dot-com stock market bubble circa 1995-2003 offers a classic example of bubble symmetry, though there are many others as well. The key feature of bubble symmetry is the entire bubble retraces in roughly the same time frame as it took to soar to absurd heights.

Nobody could see bubble symmetry coming, of course. At the peak and for some time after, bubbles are viewed as the natural order of markets and so they should continue expanding forever.

Alas, the natural order of markets is mean reversion and the collapse of whatever is unsustainable. This includes speculative manias, credit bubbles, asset bubbles and projections of endless expansion of margins, profits, sales, consumption, tax revenues and everything else under the sun.

There’s a well-worn psychological path in the collapse of bubbles. This path more or less tracks the Kubler-Ross phases of denial, anger, bargaining, depression and acceptance, though the momentum of speculative frenzy demands extended displays of hubris and over-confidence, i.e. the first wobble “must be the bottom.”