Trump says they’re untouchable. Most of the other Republican candidates and potentials say otherwise. From A.B. Stoddard at realclearwire.com:

In the prospective 2024 nominating contest, some GOP wannabes are serving up straight talk about the need to fix Medicare and Social Security, even though Donald Trump banished entitlement reform from Republican doctrine in 2016. These fiscally sober, and actually conservative, Republicans aren’t likely to win the nomination, and they’re making Trump giddy. But they could also put House Republicans and Ron DeSantis in a jam.

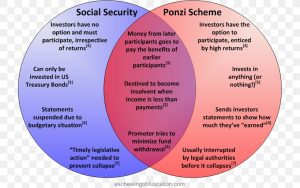

Nikki Haley, who announced her candidacy last month, and likely contenders Mike Pence and Mike Pompeo, have all said the looming insolvency of these programs – which take up 30% of the federal budget – must be addressed.

House Republicans vowing to find $130 billion in spending cuts had initially placed entitlements squarely on the negotiating table, but removed them after Trump and President Biden united against reform. Biden taunted congressional Republicans at his State of the Union, saying it was their “dream” to cut both popular programs, which was met with boos. Trump has released a video warning congressional Republicans not to cut “one penny” from either safety net program in their negotiations over the debt ceiling. After both events, House Speaker Kevin McCarthy made it explicit: In their hunt for savings they will look elsewhere and leave both programs alone.

“Clean” increases in the debt ceiling passed during Trump’s presidency, while the debt increased by 39%. House Freedom Caucus members, who rode the Tea Party wave and sought drastic spending cuts for years, went all in on the Trump spending bender. One of those Freedom Caucus members who went on to serve as both budget director and then chief of staff to Trump – Mick Mulvaney – told The Dispatch, “The truth of the matter is that the first two years of the Trump administration, when the Republicans had the House and the Senate, we raised spending faster than the last couple of years of the Obama administration.”