The Japanese are giving a pretty good demonstration, to be followed by Europe and the U.S. From John Rubino at rubino.substack.com:

Gradually then suddenly (2024?)

The past few decades of unnaturally easy money have created a world of “moral hazard” in which a ridiculous number of people borrowed far more than they should have. Now, with money getting tighter, not just businesses and individuals but some governments are staring at the “suddenly” part of that old saying about bankruptcy.

Japan is the poster child for this slow walk towards – then quick rush over – a financial cliff. Here’s how it works for a government, in 10 steps.

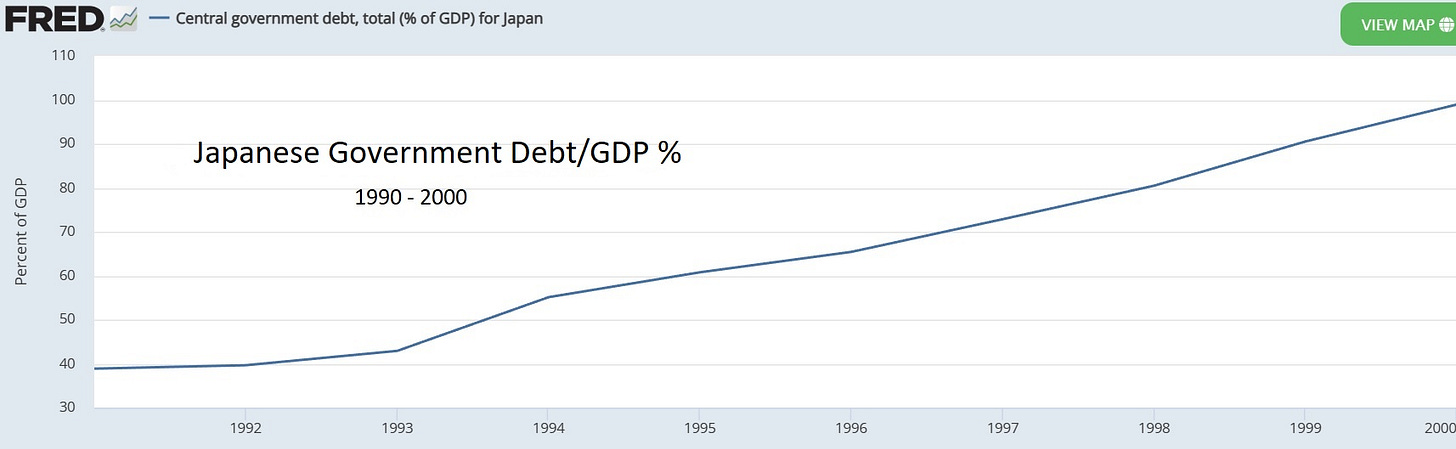

Step 1: Build up massive debt. A bursting real estate bubble in the 1990s confronted the Japanese government with a choice between accepting a brutal recession in which most of that debt was eliminated through default, or simply bailing out all the zombie banks and construction companies and hoping for the best. They chose bailouts, and federal debt rose from 40% of GDP in 1991 to 100% of GDP by 2000.

Step 2: Lower interest rates to minimize interest expense. Paying 6% on debt equaling 100% of GDP would be ruinously expensive, so the Bank of Japanpushed interest rates down as debt rose, thus keeping the government’s interest cost at tolerable levels.