The West’s fiat currencies are reaching the end of the line. From Alasdair Macleod at goldmoney.com:

After fifty-one years from the end of the Bretton Woods Agreement, the system of fiat currencies appears to be moving towards a crisis point for the US dollar as the international currency. The battle over global energy, commodity, and grain supplies is the continuation of an intensifying financial war between the dollar and the renminbi and rouble.

It is becoming clear that the scale of an emerging industrial revolution in Asia is in stark contrast with Western decline, a population ratio of 87 to 13. The dollar’s role as the sole reserve currency is not suited for this reality.

Commentators speculate that the current system’s failings require a global reset. They think in terms of it being organised by governments, when the governments’ global currency system is failing. Beholden to Keynesian macroeconomics, the common understanding of money and credit is lacking as well.

This article puts money, currency, and credit, and their relationships in context. It points out that the credit in an economy is far greater than officially recorded by money supply figures and it explains how relatively small amounts of gold coin can stabilise an entire credit system.

It is the only lasting solution to the growing fiat money crisis, and it is within the power of at least some central banks to implement gold coin standards by mobilising their reserves.

Zeus punished the hubristic King Sisyphus to roll a huge boulder up a very steep hill in Hades. Before Sisyphus reached the top, the stone rolled down and he had to start all over again.

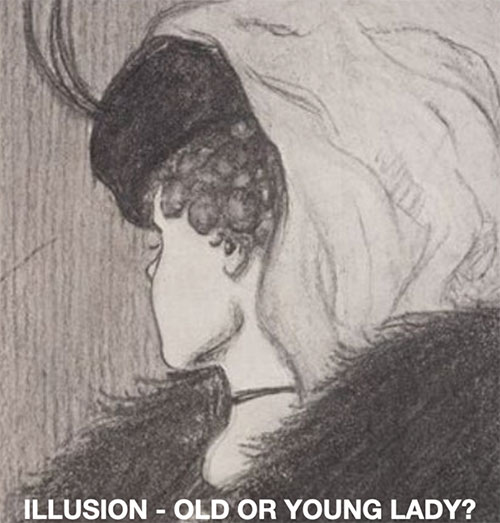

Zeus punished the hubristic King Sisyphus to roll a huge boulder up a very steep hill in Hades. Before Sisyphus reached the top, the stone rolled down and he had to start all over again. So you might ask how can it all be fake when we can touch it, use it, or experience it. For people who don’t understand that it is all fake, let me say that we will all soon realise how fake it was. Because many of these things that we perceived as real were all an illusion.

So you might ask how can it all be fake when we can touch it, use it, or experience it. For people who don’t understand that it is all fake, let me say that we will all soon realise how fake it was. Because many of these things that we perceived as real were all an illusion.